newsletter

Sign up for the Marketer QuickLook Newsletter

SMPS Headquarters

625 North Washington Street

Suite 302

Alexandria, VA

22314-1936

email

info@smps.org

phone

703.549.6117

marketing

No Crystal Balls Required

Using Client Lifetime Value to Grow Your Firm

By Kimberly Robertson, CPSM

domain

In the A/E/C industries, client relationships play a crucial role in determining firm success. However, assessing the true success of these relationships amid increasing client acquisition costs, budget constraints, and economic uncertainties requires a reliable metric. Champion clients, who consistently contribute to a firm’s success, are akin to gold. This article explores the use of predictive modeling through Client Lifetime Value (CLV) to unveil the true value of a client.

Companies that strategically enhance the CLV of their most valuable clients and transform clients perceiving them as mere “vendors” into “valued advisors” stand to gain significantly.

What You Should Know About CLV

What You Should Know About CLV

There are few experiences that match the satisfaction of closing a significant deal with a new client. However, the true success lies in the client’s sustained engagement. CLV represents the average revenue derived from a single client throughout their account’s lifetime. Knowing the value of a client is paramount for informed decisions on acquisition and retention costs.

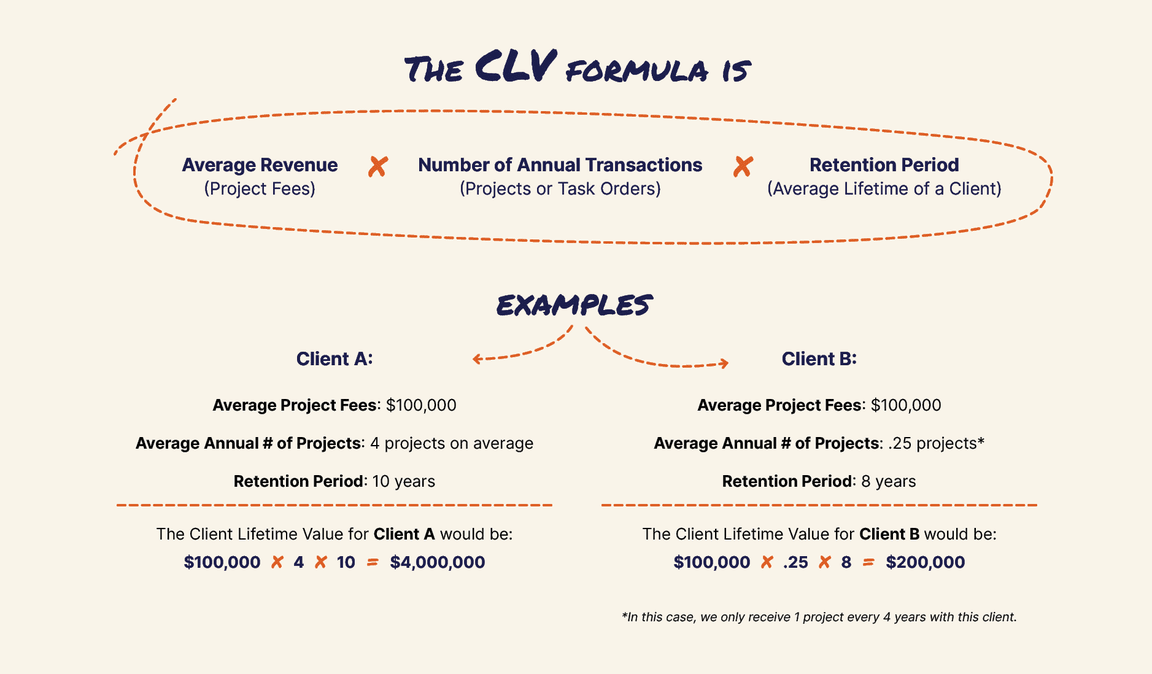

While the CLV formula can appear complex, let’s simplify it:

So What?

So What?

Consider spending $100,000 in marketing costs for both clients. For Client A, the strong pipeline of work for 10 years justifies the expense, yielding a substantial profit. In contrast, the sporadic relationship with Client B results in a meager profit, rendering the marketing costs exorbitant and unsustainable.

Why is CLV So Important?

Why is CLV So Important?

Understanding CLV allows you to drill down and understand the economic value of each client, so you can make sound decisions about how much to invest in acquisition and retention.

1. It impacts your bottom line. Total client value has a direct impact on profitability. Businesses focusing entirely on generating new business development leads and sales pay a high cost of acquiring these clients. It also means you’re getting a smaller margin for every cost proposal. Knowing what your client lifetime value is versus your client acquisition cost can shine a light on how you need to adjust your strategy to bolster margins: optimize your lead generation program, focus on delivering more value for your clients, or both.

2. You’ll practice more intelligent marketing spend decisions. The Go/No Go process can be a point of contention in any firm, with subjective answers to whether this work is valuable. However, if you understand the CLV, then you can use that as a data point to decide whether the investment will provide a strong ROI. This alone can make a big impact in the success of a marketing department.

3. It steadies your revenue generation. A steady stream of work from your existing client base stabilizes your cash flow. Understanding your CLV makes it easier to project your firm’s revenue and predict opportunities for growth.

4. You’ll find out what your clients think. What does your lifetime value tell you about your clients? If you’ve got a high figure, it tells you that your clients love to work with you, that they’re satisfied with the service you offer, and most importantly, that they have a degree of brand loyalty.

How can you increase your overall firm’s CLV?

How can you increase your overall firm’s CLV?

The problem with the lifetime value calculation is it gives you nothing but a number. How can you use this information to make stronger decisions?

1. Interview your most valuable clients. The first step to increasing your lifetime value is to understand what brought you to that number in the first place. An excellent initial tactic is to get in touch with your most valuable clients and learn more about them. Ask probing questions or use client satisfaction surveys to understand why they selected your firm, what keeps them coming back for more work, and things they would like to change or improve about your service.

2. Promote cross-selling or up-selling opportunities. “I didn’t know your firm did that!” can be a surprising, but illuminating response when you bring up new service solutions. While your diverse services may seem evident to you, it may not be so evident to your clients. Conversely, some clients don’t always know what they need, so they ask for what is evident to them. Put on your detective hat and ask inquisitive questions that might lead to opportunities to expand your firm’s scope.

3. Invest in the client experience. Client retention and experience go together as retention is the result of positive client experience. Improving client experience not only has an immense effect on brand loyalty but will ultimately increase client lifetime value. To understand where you should invest, I encourage you to map out the client journey, identifying specific touchpoints that clients engage with your firm, and finding any pain points or area of improvement.

The System Isn’t Without Flaws

The System Isn’t Without Flaws

It’s not uncommon for companies to use historical sales as a measure of client value. This can be a mistake, as client who were good in the past will not necessarily be your best clients in the future. While the formula is straightforward, keep in mind that it assumes a constant churn rate and average revenue, which may not hold true in all scenarios. Instead, it should be a predictive model to support other aspects.

For instance, if a school district had a five-year bond measure passed, resulting in $1 million in project fees across that five-year period, that does not indicate that the future will result in the same amount of revenue, especially if the bond funds have been used. However, you can use this method to understand whether the investment in this client was profitable, to predict whether they will be good for the firm in the future when they pursue a new bond measure.

No Crystal Balls Required

No Crystal Balls Required

Firms employing CLV can assess the impact of client investments, guiding future opportunities. This tool proves effective for company growth, especially for those without crystal balls or who haven’t yet perfected client telepathy.

Share:

Kimberly Robertson, CPSM is HDR’s Federal Communications Manager and a Certified Professional Services Marketer. Her marketing and communications expertise spans many disciplines, including account management, proposal leadership, content creation, campaign programs, and talent brand management. In her most recent role with HDR, she was directly responsible for the strategic marketing direction for a federal market sector, resulting in a 75% revenue increase in a mere 3 years.

Connect with Kimberly on

READ NEXT